PAMM Account Overview

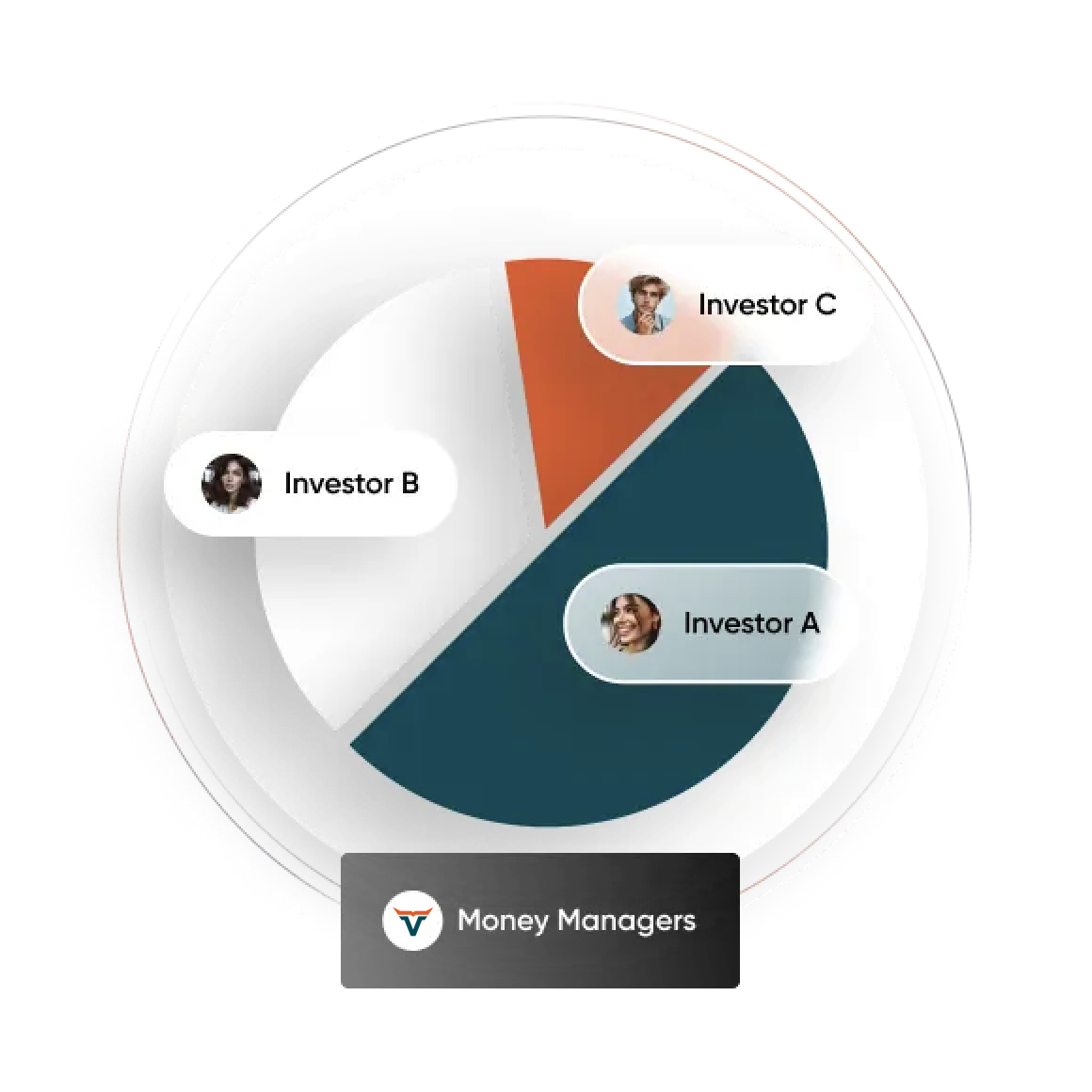

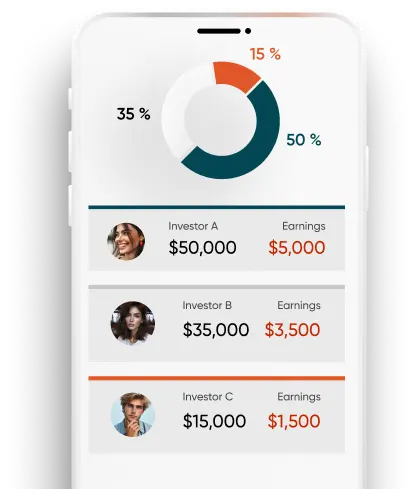

Percentage Allocation Money Management (PAMM) is a solution where a professional account manager executes trades on behalf of clients. In this setup, the account manager acts as the Fund Manager, while the clients are the Investors.The PAMM accountallows investors to pool their funds together, providing them with access to professional fund managers and their trading strategies.